|

|

<

![]()

|

AN ACCOUNT AT MARTINS BANK |

![]()

|

|

|||||||||||||||||||

|

It is not necessary to be rich to have a

banking account, but more and more people are beginning to appreciate the

convenience and wisdom of keeping their money in a bank. There are three principal ways in which a banking account

can be of great help: by ensuring the absolute safety of your money; by

offering a method of keeping your financial affairs in order; and by

providing a means of saving. There are three main types of account which you

can open at

Martins Bank—current

accounts, deposit accounts and savings accounts. Current accounts The current account is the usual type of

account into which you can pay the money you receive and out of which you can

draw cash as you require it or pay your various outgoings. For instance, you

can pay in your salary or wages or arrange for them to be put into your

account direct, and you can pay in any other cash or cheques or dividends

which you may receive; and all your outgoings such as coal, gas, electricity,

rent, rates, taxes, insurance premiums, hire-purchase instalments and so on

can be paid either by cheque or by credit transfer. If you are a housewife,

you can pay in your housekeeping allowance and settle your accounts at the

various shops by cheque. The Bank keeps a record of your account for you,

which is called a statement. In one column are listed all the amounts paid

in, and in another all the amounts paid out, the remaining balance being

clearly shown. This enables you to have a useful picture of your financial

affairs —and

that is a big step towards saving.

Deposit accounts, on which interest is payable,

are for money placed “on deposit” for a minimum of seven days, and for which

seven days' notice of withdrawal is normally required. Savings accounts Savings accounts, on which interest is

also allowed, can be opened at Martins Bank by anyone. Deposits of 1/-d. or

more will be accepted, and a special box can be provided for collecting notes

and coins at home. A cheque book is not issued for a savings account but

withdrawals of up to £20

can be made at any branch of Martins Bank or Lewis's Bank on production of

your passbook containing a specimen of your signature.

The cost of a banking account Each half year the Bank makes a charge for

operating a current account, according to the work that is involved. The

amount is often surprisingly small and indeed may be nothing at all if a

reasonable balance is kept. No charges are made on deposit or savings

accounts. If you wish, your account can be opened in joint names—your

own together with that of either your wife or some other person(s).

If you call at any of the Bank's branches or

write to the manager, we will be

pleased to give you full details and help

you to decide which type of account will suit your needs.

Your cheques cashed The

Bank will arrange for you to cash your cheques

anywhere in the country where there is a bank,

either at one of its own branches or at a branch of

another bank. Financial assistance The

Bank will be prepared to discuss with you the granting of an overdraft or other

financial assistance if ever this is required. Investment service If

you want help or advice about investments, our Managers will gladly obtain

for you advice from the experts in such matters. H.P. instalments,

insurance premiums and other regular

payments. You

can arrange for the Bank to make these payments automatically from your

account when they become due. Your Income Tax

If you wish, the Bank will attend to your Income

Tax affairs for you. Your

Will The

Bank can act as Executor or Trustee for you. Foreign currency and travellers' cheques. If

you go abroad the Bank can supply foreign currency, and travellers' cheques

which can be exchanged for foreign currency. Martins Bank travellers'

cheques can be used in this country as well. Bankers Cards Bankers

Cards are available to approved customers so that their cheques are more

readily acceptable in payment for goods and services, or can be cashed

without prior arrangement at a large number of

branches of banks all over Britain and Ireland.

A

reference supplied The Bank can supply a

reference for you, a useful facility if you

are applying for a passport or opening a

shopping or credit account. Your valuables guarded The

Bank provides accommodation in its strong rooms and safes for your deeds, share certificates,

or other documents of value, and for locked boxes

or sealed parcels containing jewellery or other

valuables. In all these matters strict secrecy is observed

and your affairs

will not be divulged to any other person—not

even to a relation—without your knowledge and

permission. In addition., any customer can

draw upon the experience and knowledge of the bank manager and enjoy his friendly help and guidance

without obligation.

At this point we should perhaps tell you something about

ourselves. Martins Bank operates over 700 branches throughout England,

Wales., the Channel Islands and the Isle of Man. The Bank started as the Bank of

Liverpool over 130 years ago but the old private bank., Martin's Bank.,

London., which became part of the larger bank in 1918, dates back to 1563.

The grasshopper in the Bank's coat of arms is the emblem which Sir Thomas Gresham,

the famous Elizabethan financier, displayed outside his house in Lombard

Street, where our principal London office now stands, and where banking

business has been done without a break since the sixteenth century. The bird which is prominently displayed

on our coat of arms is the Liver Bird of Liverpool. The constant aim of our

managers and every member of our staff is the maintenance of a friendly

personal relationship with every customer, whose presence in the bank is

always welcomed whether he has £i or £1,000 in his account. Again and again our

customers tell us "Martins Bank is such a friendly bank" and we

train our staff in this tradition to provide a very important public service. It is also of interest to note that in

the course of our growth we have absorbed or amalgamated with over thirty

smaller banks, many of them family concerns who have the same excellent

tradition. We hope, after what we have said, that you will feel that we have

something to offer you and you will now want to know how to set about opening

your account and how to conduct it.

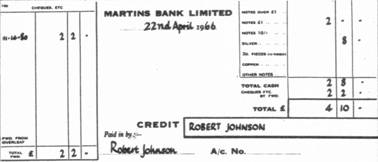

Paying money in

Other accounts

The procedure for opening a deposit

account or a savings account is equally simple: anyone behind the counter

will explain it to you. No reference is needed to open a savings account. The use of a cheque book The Bank itself makes

no charge for a cheque book, but it collects the stamp duty of 2d. on each cheque

and hands it over to the revenue authorities. Cheques for current accounts

are supplied in books of various sizes to suit requirements. The use of a

cheque book avoids the necessity of carrying large sums of cash about with

you and can provide also a convenient record of the payments you make from

your balance in the Bank. You can give cheques to almost anyone to whom you

owe money. You also use cheques to draw cash for yourself from your account

and, as we mentioned earlier, one of the great advantages of having a banking

account is that we can arrange for you to get cash in this way at any branch

of any bank in the British Isles. This is an added convenience if you are

staying in a place where there is no branch of Martins Bank.

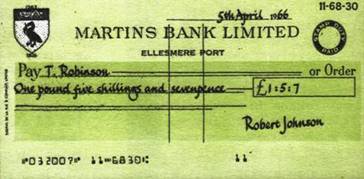

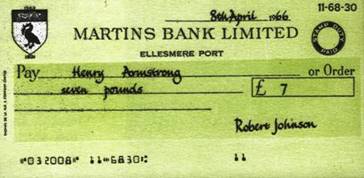

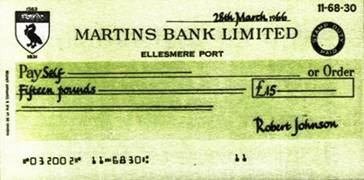

To write a cheque, you fill in the name

of the person or firm to whom payment is to be made; then, of course, you

must write in the amount of money, which must be in both words and figures as

a safeguard against accidentally filling in the wrong amount; you should

write the date in the space provided and finally put your signature at the

bottom. When writing your cheques there are a few simple rules to be observed

for both your protection and ours: 1

Always

write your cheques in ink. 2

Start

writing as far over to the left-hand side as possible and do not leave spaces

between words. The same applies to figures. If too much space is left, the

word 'seven', for example, could be altered to 'seventy' and '£7'

to '£70'. 3 If you make a mistake, alter

it in a legible way, preferably by crossing it out and re-writing the altered

word or figure; sign your name against

each alteration. 4 Always sign your cheques in the same manner

as you did when you gave the specimen of your signature on opening your

account, otherwise its authenticity may be queried. 5 Remember to fill in the counterfoil or

record sheet. Not only does this

enable you to keep up-to-date with your financial position, but you can

compare the particulars with your bank statement and, should a cheque be lost

or if for any reason you wish to stop payment of it, you will be able to give

the Bank the exact details. 6 Except where you want to draw cash for your

self, it is a valuable safeguard to 'cross' your cheques in the manner

indicated in the illustration which shows the correct way to write a cheque.

This prevents anyone from getting cash at a bank counter if, for example, you

dropped a cheque in the street and someone picked it up and tried to cash

it, because a cheque which is crossed has to be paid into a banking account

and cannot be cashed across the counter. Your cheque book can be supplied

with cheques already crossed, or you can draw the two parallel lines on each

cheque yourself when required. The disadvantage of a book of crossed cheques

is that when you want to draw money yourself you have to 'cancel the

crossing' by writing between the parallel lines 'Please pay cash' and adding

your usual signature, as shown in the illustration 7 When you use a cheque for the purpose of

drawing cash for yourself you should endorse it by signing your name on the

back, as indicated in the illustration.

1. Always

keep your cheque book in a safe place where no one can have access to it but

yourself. 2. Never

leave it lying about, as there is always thedanger that cheques might be torn

out of it by someone and improper use made of them. 3. Never

sign your name on the cover—someone might copy your signature on to a cheque. 4. Never

sign a cheque and leave the other spaces blank—someone might complete the cheque and obtain

money on your signature. 5. Never

allow anyone to have a cheque out of your book, even if that person says he

is a customer of the Bank. 6.

If your cheque book is missing or if you

mislay a cheque out of it, inform your bank manager immediately and ask him

to stop payment of it.

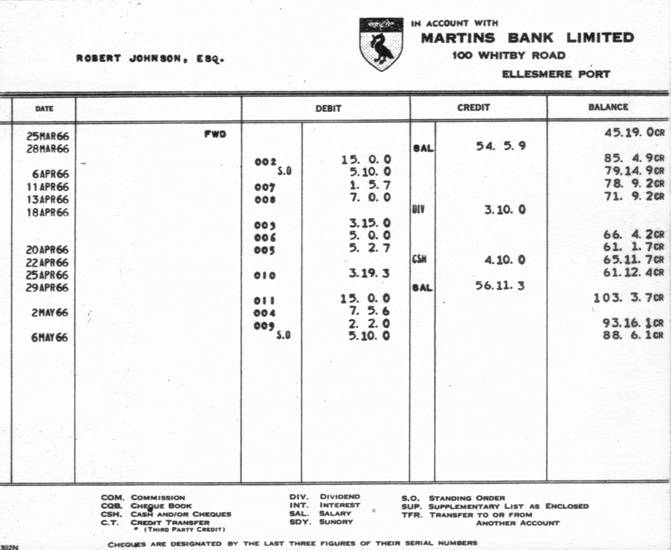

The Bank keeps a

statement of your current or deposit account listing all the amounts you

have paid in and paid out3 and showing the balance which remains.

You can arrange for your statement to be sent to you at regular intervals or

the Bank will be pleased to give you any information about your account at

any time you require it.

To give you more details of some of the services of

Martins Bank the following publications are available free of charge at any

branch: Executor and

Trustee Services Income Tax Money for

Travel Your

Investments - The Bank also publishes three guides: ·

Starting a Business in Britain Information

about business in this country

written primarily for the overseas

businessman ·

The World is Your Market ·

A

guide to overseas trading Finance

for Farmers and Growers Describes the grants and

loans available from various sources

Leeds 28-30 Park Row, 1 Liverpool 4 Water Street, 2 London 68 Lombard Street, E.C.3 Manchester 43 Spring Gardens, 2 Midland 98 Colmore row, Birmingham, 3 North Eastern 22 Grey Street., Newcastle upon

Tyne, 1 South Western 47 Corn Street, Bristol, 1 Over 700 branches throughout the country

|

|||||||||||||||||||