|

|

<

![]()

|

GRIFFIN ASSURANCE

COMPANY LIMITED |

|

{MARTINS Bank Trust Company have

taken over the Griffin Assurance Company, a subsidiary of London and

Edinburgh Life Insurance Company. Griffin issue life assurance contracts in

the group now managed by Martins Unicorn.

The Purchase price has not been revealed.} Something

else that is not immediately revealed, is the speed with which Martins Bank

Trust Company wants to completely take over Griffin Assurance, revamp its

products AND its workforce. The following text is taken from an

extensive internal memo from Martins Bank Trust Company revealing some

interesting thoughts on sales techniques, many of which would become standard

across all banks in the 1980s and 90s, and, sadly, some of which might be of

the kind that led to some of the more unsavoury aspects of hard-selling that

dogged the banking industry in Britain towards the end of the twentieth

century… Newspaper Text © Reach PLC and Find my Past

created courtesy of THE BRITISH LIBRARY BOARD.

|

|

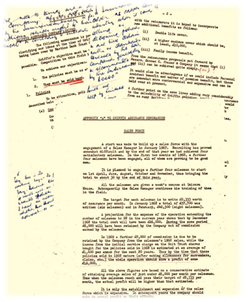

The following memorandum is

produced in order to assist in clarifying our ideas at the time of Griffin

Assurance Company Limited, being taken over by Martins Bank Trust Company

Limited. Griffin's objective must be

to sell as many policies as is possible. Competition in this field is

severe. To achieve our objective: 1.

The policies must be as attractive as possible. 2. They must be sold HARD. To be attractive, policies must

have three factors as described below. a. Competitive Premiums: Considerations for

competitive premiums must include the following: (i) There must be a

high percentage of the premiums invested and this implies that the expenses portion

of the premium must be kept as low

as possible. At present our rates are reasonably good. (ii) Nevertheless,

the premium rates must allow for sufficient commission and renewal

commissions to be paid to Brokers and salesmen, which

our current premiums do not do. (iii) Economical

administration is essential. With Griffin this is largely obtained through computerisation.

The present staff of four are dealing

with up to 140 policies a month. Future production should, however, Be at

least four times this and some addition to the

staff will be necessary. Careful investigation will be made to see whether

any further economies can be achieved. (iv) It is possible

that a new reinsurance treaty might reduce the mortality premium, and

underwriting procedures may have to be reviewed. It is intended to amend the proposal form after discussion

with reinsurers. We wish to continue our policy of not pursuing medical

evidence at present in the interests of simplicity and keeping down expenses. b. Good Unit Trusts The Unit Trust investment is

of overriding importance. Good past and current results can unquestionably make

a vast difference to the selling of U.G.A.S.P. c. Good Benefits

The benefits of our policy at present are not as flexible as those of

some of our competitors, but after discussion with the reinsurers it is hoped

to incorporate new additional

benefits as follows:

(i) Double life cover.

(ii) A higher maximum cover

which should be, at least, £10,000.

(iii) Family income benefit. From the reinsurance proposals put

forward by Messrs. Duncan C. Fraser & Company it seems that (i) and (ii)

can be achieved quite simply. It would also be advantageous if we could

include Personal Accident benefit and waiver of premium benefit, but these are

somewhat more controversial and expensive and can be held over at present. A

further point on the same lines adding very considerably to the saleability

of Griffin policies, would be an assurance from as many Building Societies as

possible that they would accept Griffin policies as security for a mortgage.

Our efforts in this direction have not so far met with much success, but

policies have been accepted by the Co-operative Permanent and the Burnley

Building Societies. SELLING Three methods of selling are open

to us:

(a) By advertisements incorporating a proposal form.

(b) Through Bank branches.

(c) By a sales force. While there are still many people

who will complete a proposal for life assurance if they see the right

advertisement at the right time, this can be an expensive method of obtaining business and can lead to a somewhat

excessive proportion of surrenders, partly due to policyholders who may not

have fully understood what they are doing. Currently an advertising campaign

is being tried in the national press. The

better alternative is by selling face to face. The Bank branches can be

invaluable in this context. They do, however, suffer from the limitation that

they cannot go out and find business but must wait for it to come to them. Our

own sales force can, however, call not only on those from whom we have

received enquiries, but also to some extent on members of the public who

might otherwise never know of unit linked policies. Some of our competitors’

salesmen, notably those of Save and Prosper, do call on members of the public

(without prior introduction, and our own. sales force spend about 25% of

their time on this type of business. The business they produce is likely to

be (and in our experience has so far proved to be) of better quality, both in

age, duration and monthly premiums. There is also likely to be a considerably

lower surrender rate. Considerations for dealing with the sales force are

attached as an appendix. Unlike

selling Unit Trust shares, it is not possible to see an immediate return for

the outlay. It is probable that the average selling costs for a Griffin

policy must amount to 3% to 4% of the sum assured, but the full earnings for

the Group do not appear until the policy matures and all the money has been

invested some 18 years later. Nevertheless, assuming that the expense rates

in new premiums to be calculated are increased, the initial selling expense

should have been recouped within six years, and maybe sooner. It seems right that advertising and other

promotional costs should be borne by Martins Unicorn, and indeed any other expenses,

such as, part cost of the sales force, which the gross profits of Griffin are

unable to cover. APPENDIX SALES FORCE A

start was made to build up a sales force with the engagement of a Sales

Manager in January 1967. Recruiting has proved somewhat difficult and by the

end of that year we had achieved four satisfactory salesmen. In the first two

months of 1968, a further four salesmen have been engaged, all of whom are

proving to be good men. It is planned to engage a further four salesmen to

start on 1st April, June, August, October and November, thus bringing the total

to about 30 by the end of this year. All the salesmen are given a week’s

course at Unicorn House. Subsequently the Sales Manager continues his

training of them in the field. The target for each salesman is to write

£8,333 worth of Assurance per month. In January 1968 a total of £57,700 was written

(six salesmen) and in February, £42,500 (eight salesmen). A projection for the

expense of the operation extending the number of salesmen to 28 in the

current year shows that by December 1968 the total cost will have been

£26,000. During the same period £6,000 will have been retained by the Company

out of commission earned by the salesmen. In 1969 a further £8,000 of

commission is due to be retained by the Company from the salesmen’s 1968

sales, while the income from the initial service charge on the Unit Trust

shares bought for the policies sold in 1968 is estimated at an average of £1,400

per annum for the next 20 years. Thus by the time that those policies sold in

1968 mature (after making allowances for surrenders, claims, etc.) the whole operation

show a profit of some £16,000. All the

above figures are based on a conservative estimate of attaining average sales

of just under £6,000 per month per salesman. Thus when the salesmen reach and

pass their target of £8,333 Per month, the actual profit will be higher than

that estimated. It is only the establishment and expansion of the sales force

which is expensive. In subsequent years the company should make an annual

profit on their efforts. |

|

|

|

|